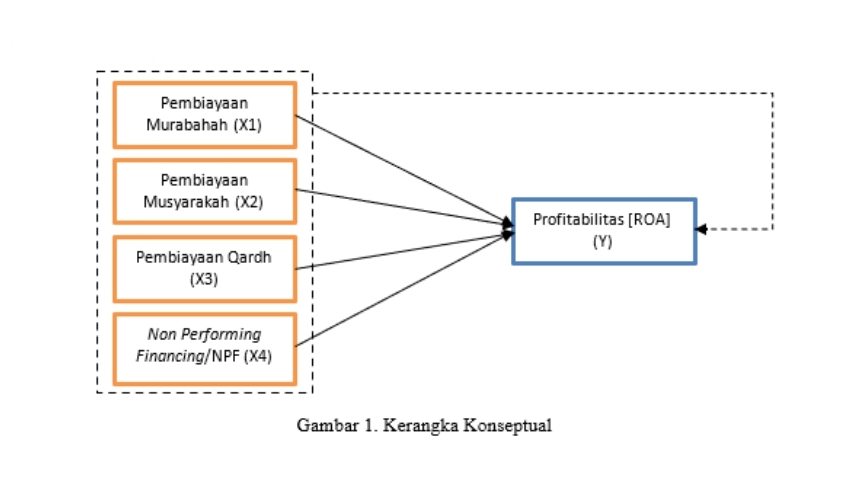

Pembiayaan Murabahah, Musyarakah, Qardh Dan NPF Terhadap Profitabilitas BUS Tahun 2018-2022

##plugins.themes.academic_pro.article.main##

Abstract

Sharia commercial banks are financial institutions that carry out their activities by following sharia principles and also play a role in managing payment flows. As an integral part of the sharia financial sector, sharia commercial banks have an important role in driving Indonesia's economic growth. This research aims to investigate the impact of murabahah, musyarakah, qardh, and non-performing financing (NPF) on the profitability of sharia commercial banks from 2018 to 2022. The research population consists of sharia commercial banks registered with the Financial Services Authority (OJK), with a total sample of five sharia commercial banks, selected through a purposive sampling method. The research approach used is descriptive quantitative with data analysis using multiple linear regression. The results of the analysis show that partially, murabahah and NPF financing have a significant influence on profitability, while musyarakah and qardh financing do not have a significant influence. Overall, murabahah, musyarakah, qardh and NPF financing together influence the profitability of sharia commercial banks.

##plugins.themes.academic_pro.article.details##

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

LPPM Politeknik Piksi Ganesha Indonesia

References

Andriani, A. (2020). Pengaruh Pembiayaan Qardh, Ijarah, Dan Istisna Terhadap Profitabilitas Pada Bank Pembiayaan Rakyat Syariah (BPRS) Di Indonesia.

Ariyanti, O. N., & Sawitri, R. A. (2023). Pengaruh Pembiayaan Mudharabah, Musyarakah, Murabahah, Ijarah Dan Qardh Terhadap Tingkat Profitabilitas Bank Syariah Indonesia. JurnalAkuntansi Dan Keuangan Islam, Volume 04, 139–154.

Azizah, F. N. (2022). Analisis Faktor Yang Mempengaruhi Non Performing Financing (NPF) Pada Bank Umum Syariah Indonesia Tahun 2017-2021.

Cahyaningsih, D. S., Maslacha, N., & Kumar, A. M. (2021). Pengaruh Risiko Pembiayaan terhadap Kinerja Profitabilitas pada BMT “S” Syariah Jawa Timur. Jurnal Ilmiah Akuntansi Manajemen, 4(2), 112–120. https://doi.org/10.35326/jiam.v4i2.1617

Candera, M., & Hustia, A. (2019). Pengaruh Pembiayaan Qardh, Ijarah Dan Istishna Terhadap Profitabilitas Bank Pembiayaan Rakyat Syariah (Bprs) Di Indonesia. Jurnal Manajemen Dan Keuangan, 8(1), 58–67. https://doi.org/10.33059/jmk.v8i1.1183

El Ayyubi, S., Anggraeni, L., & Mahiswari, A. D. (2018). Pengaruh Bank Syariah terhadap Pertumbuhan Ekonomi di Indonesia. Al-Muzara’ah, 5(2), 88–106. https://doi.org/10.29244/jam.5.2.88-106

El Husna, N. (2022). Pengaruh pembiayaan qard, rahn dan ijarah terhadap profitabilitas bank syari’ah mandiri periode 2016-2020. Jurnal Ilmu Manajemen Terapan, 4(2), 259–278.

Ellina Monica Septiani, & Listyorini Wahyu Widati. (2023). CAR, NPF, FDR, dan BOPO Terhadap Profitabilitas Bank Umum Syariah. Kompak :Jurnal Ilmiah Komputerisasi Akuntansi, 15(2), 527–539. https://doi.org/10.51903/kompak.v15i2.809

Garwautama Sulaeman; Noor, Iqbal, P. K. S. (2021). Pengaruh Pembiayaan Murabahah, Pembiayaan Musyarakah, Pembiayaan Qardh Terhadap Profitabilitas. Balance : Jurnal Akuntansi Dan Bisnis, 6(2), 145–156. https://jurnal.um-palembang.ac.id/balance/article/view/3873/2578

Hanifah Putri, N., & Mulyani, E. (2022). Pengaruh Audit Jarak Jauh (Remote Audit) dan Jumlah Penugasan Auditor terhadap Kualitas Audit: Studi Empiris pada Perwakilan BPKP Provinsi Sumatra Barat. In Jurnal Eksplorasi Akuntansi (JEA) (Vol. 4, Issue 4). Online. http://jea.ppj.unp.ac.id/index.php/jea/index

Harahap, & Sofyan Syafri. (2008). Analisis Kritis Atas Laporan Keuangan. Raja Grafindo.

Hartati, D. S., Dailibas, & Mubarokah, I. (2021). Pengaruh Pembiayaan Mudharabah , Musyarakah Dan Ijarah Terhadap. Jurnal Ilmiah Ekonomi Islam, 7(01), 235–240.

Husna, N. El. (20222). Pengaruh pembiayaan qard, rahn dan ijarah terhadap profitabilitas bank syari’ah mandiri periode 2016-2020. Jurnal Ilmu Manajemen Terapan.

Jannah, S. Q. C. (2020). Pengaruh Transaksi Pembiayaan Terhadap Profitabilitas Bank Syariah Mandiri Periode 2010 - 2019.

Khairani, Z., Eka Puteri Pascasarjana Fakultas Ekonomi dan Bisnis Islam, H., & Sjech Djamil Djambek Bukittinggi, U. M. (2024). PENGARUH PEMBIAYAAN MURABAHAH, MUSYARAKAH, DAN QARDH TERHADAP PROFITABILITAS BANK SYARIAH DI INDONESIA. JEBI: Jurnal Ekonomi Dan Bisnis, 2(1). www.ojk.go.id

Mansur, A. (2011). Peran Bank Syariah Di Dalam Pembangunan Ekonomi. El-Qist: Journal of Islamic Economics and Business (JIEB), 1(1), 63–88. https://doi.org/10.15642/elqist.2011.1.1.63-88

Maulidizen, A., & Nabila, N. (2019a). Pengaruh Pembiayaan Murabahah Terhadap Profitabilitas Bank Umum Syariah di Indonesia Periode 2010-2017. Jurnal Penelitian IAIN Kudus, 13(2), 215–250. https://doi.org/http://dx.doi.org/10.21043/jp.v13i2.6397

Maulidizen, A., & Nabila, N. (2019b). Pengaruh Pembiayaan Murabahah Terhadap Profitabilitas Bank Umum Syariah di Indonesia Periode 2010-2017. Jurnal Penelitian IAIN Kudus, 13(2), 215–250. https://doi.org/http://dx.doi.org/10.21043/jp.v13i2.6397

Nurnasrina, SE. , M. Si., & P. Adiyes Putra, M. S. (2018). Manajemen Pembiayaan Bank Syariah (M. Si. Nurlaili, Ed.). Cahaya Firdaus Publishing and Printing .

Oktaviani, D. U., & RR. Indah Mustikawati, M. Si. , Ak. , CA. (2020). THE EFFECT OF MURABAHA, MUDHARABA, MUSYARAKA, AND IJARA FINANCING ON PROFITABILITY AT KSPPS BTM KOTAGEDE PERIOD 2014-2018.

Putra, P., & Hasanah, M. (2018). PENGARUH PEMBIAYAAN MUDHARABAH, MUSYARAKAH, MURABAHAH, DAN IJARAH TERHADAP PROFITABILITAS 4 BANK UMUM SYARIAH PERIODE 2013-2016. www.bi.go.id,

Rahmadi, E. (2017). Analisis Pengaruh Pembiayaan Murabahah, Mudharabah, Musyarakah dan Ijarah Terhadap Tingkat Profitabilitas Di Bank Umum Syariah Periode 2011-2016. In 2017.

Rahmah Kusuma, N., Fauziya Diyana, A., Syari’ah Pascasarjana, J. E., Syekh, I., & Cirebon, N. (2021). ANALISIS PENGARUH FDR DAN NPF TERHADAP PROFITABILITAS BANK SYARIAH DI INDONESIA. www.syekhnurjati.ac.id/jurnal/index.php/inklusif

Resyarahma, M. (2021). PENGARUH PEMBIAYAAN MUDHARABAH, MUSYARAKAH DAN MURABAHAH TERHADAP PROFITABILITAS BANK UMUM SYARIAH DI INDONESIA TAHUN 2016-2019.

Riyadi, S., & Yulianto, A. (2014). Pengaruh pembiayaan bagi hasil, pembiayaan jual beli, financing deposit to ratio (FDR) dan non performing financing (NPF) terhadap profitabilitas bank umum syariah di Indonesia. Acounting Analysis Journal, 3(4), 466–474.

Soegiarto. (2018). Pengaruh CR, DER, NPF Terhadap ROA BMT Nurus Sa’adah Di Pekalongan. RISET & JURNAL AKUNTANSI.

Sugiyono. (2011). Metode Penelitian Kuantitatif dan R&D Edisi Revisi. Alfabeta .

Syakhrun, M., Anwar, A., & Amin, A. (2019). Pengaruh Car, Bopo, Npf Dan Fdr Terhadap Profitabilitas Pada Bank Umum Syariah Di Indonesia. Bongaya Journal for Research in Management (BJRM), 2(1), 1–10. https://doi.org/10.37888/bjrm.v2i1.102

Verizaliani, V. D., & Mubarokah, I. (2021). PENGARUH PEMBIAYAAN MURABAHAH DAN MUSYARAKAH TERHADAP PROFITABILITAS. In Competitive Jurnal Akuntansi dan Keuangan (Vol. 5, Issue 2).

Wahyu Ramadhan, A. (2023). ANALISIS PENGARUH PEMBIAYAAN MURABAHAH, MUSYARAKAH, DAN QARDH TERHADAP PROFITABILITAS BANK BTPN SYARIAH PERIODE 2019-2023. Islamic Economics and Finance in Focus.

Wahyuni, S. (2022a). The Effect of Buy and Sell Financing (Murabahah), Profit Share Financing (Mudarabah), Equity Capital Financing (Musyarakah), and Non-Performing Financing Ratio towards Firm Performance: The Role of Profitability as mediating and Firm size as Moderating Va. Scholars Journal of Economics, Business and Management, 9(4), 95–104. https://doi.org/10.36347/sjebm.2022.v09i04.004

Wahyuni, S. (2022b). The Effect of Buy and Sell Financing (Murabahah), Profit Share Financing (Mudarabah), Equity Capital Financing (Musyarakah), and Non-Performing Financing Ratio towards Firm Performance: The Role of Profitability as mediating and Firm size as Moderating Variables in Sharia Commercial Banks in Indonesia. Scholars Journal of Economics, Business and Management, 9(4), 95–104. https://doi.org/10.36347/sjebm.2022.v09i04.004

Wulandari, J. R. (2017a). THE EFFECT OF MUDHARABAH AND MUSYARAKAH ON THE PROFITABILITY OF ISLAMIC BANKS. In 2017.

Wulandari, J. R. (2017b). THE EFFECT OF MUDHARABAH AND MUSYARAKAH ON THE PROFITABILITY OF ISLAMIC BANKS. In 2017.