Investasi BerkelanjutanPeran INA (Indonesia Investment Authority) dalam Optimalisasi Kerangka ESG (Environment, Social and Governance)

##plugins.themes.academic_pro.article.main##

Abstract

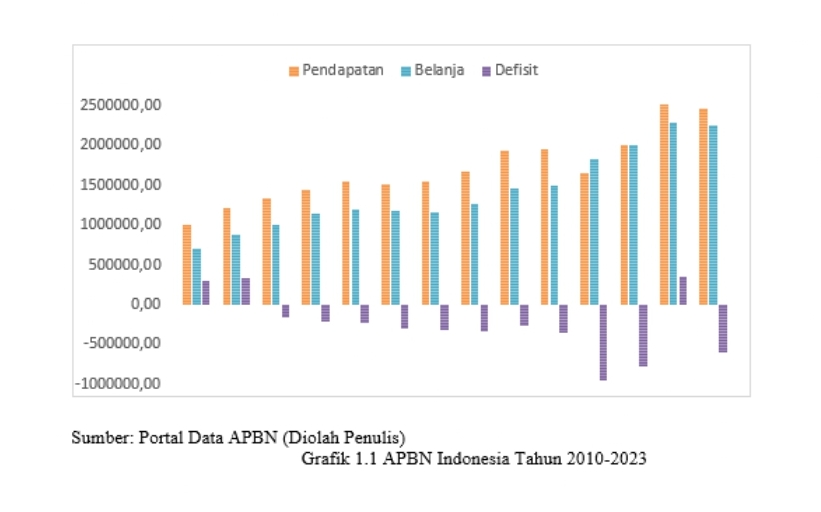

Infrastructure development stands as a main focus for the government in achieving Indonesia Emas 2045. Referring to the expansive State Budget, it urges the government to optimize the investment funding of the Sovereign Wealth Fund (SWF), known as the Indonesia Investment Authority (INA). INA is aimed at aligning infrastructure development with the enhancement of environmental, social, and governance (ESG) standards. The research utilized a literature review to examine the development of ESG integration within INA and its implementation in different countries. The findings indicate that INA has begun incorporating ESG principles in its investment activities, as highlighted in the 2022 INA Annual Report. Nevertheless, there is a need for INA to further refine its ESG practices, drawing inspiration from the regulatory frameworks and corporate collaborations seen in China and Norway. To this end, INA is anticipated to advance its ESG efforts by focusing on environmental, social, and governance metrics

##plugins.themes.academic_pro.article.details##

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

LPPM Politeknik Piksi Ganesha Indonesia

References

Al Amosh, H., Khatib, S. F. A. , & Ananzeh, H. (2022). Environmental, Social and Governance Impact on Financial Performance: Evidance from tge Levant Countries. Corporate Governance (Bingley), 23(3), 493–513. https://doi.org/https://doi.org/10.1108/CG-03-2022-0105

Arif-Ur-Rahman, M., & Inaba, K. (2021). Foreign Direct Investment and Productivity Spillovers: A Firm-Level Analysis of Bangladesh in Comparison with Vietnam. Journal of Economic Structures, 10(1). https://doi.org/10.1186/s40008-021-00248-2

Astuti, E., & Ihsanin, A. (2022). Kebijakan ESG di Kemenkeu: Apakah hanya Greenwashing Belaka?

Chen, G., Wei, B., & Dai, L. (2022). Can ESG-Responsible Investing Attract Sovereign Wealth Funds’ Investments? Evidence From Chinese Listed Firms. Frontiers in Environmental Science, 10. https://doi.org/10.3389/fenvs.2022.935466

Febriyanta, I. M. M. (2021). Mengenal SOvereign Wealth Fund, Dana Investasi untuk Masa Depan Bangsa. https://www.djkn.kemenkeu.go.id/artikel/baca/13654/Mengenal-Sovereign-Wealth-Fund-Dana-Investasi-untuk-Masa-Depan-Bangsa.html

Guciano, H. S. (2023). Relevansi SWF bagi Kemakmuran Bangsa. Kompas. https://www.kompas.id/baca/opini/2023/12/31/relevansi-swf-bagi-kemakmuran-bangsa

Hoa, T., Phan, T., Hua, P. L., Trang, T., Thi, N., Phung, D. T., Pham, H. T., & Tran, P. L. (2024). Environment, Social and Governance Investment, the Current Situation and Proposed Solutions for Vietnam. International Journal of Multidisciplinary Research and Analysis, 7(3), 906–909. https://doi.org/10.47191/ijmra/v7-i03-07

Jamaludin, M. (2023). Indonesia Investment Authority sebagai SWF Indonesia Untuk Meningkatkan Investasi Asing di Indonesia. 1(2).

Kementerian Keuangan. (2022). Kerangka Kerja Lingkungan, Sosial, dan Tata Kelola (LST) pada Dukungan dan Fasilitas Pemerintah untuk Pembiayaan Infrastruktur.

Kementerian Perencanaan Pembangunan Nasional. (2023). Rancangan Akhir Rencana Pembangunan Jangka Panjang Nasional 2025-2045. https://drive.google.com/file/d/1JSZp1Oz37KWktxi-hi0okVXxEsKuaU-I/view

Li, T. T., Wang, K., Sueyoshi, T., & Wang, D. D. (2021). Esg: Research Progress and Future Prospects. In Sustainability (Switzerland) (Vol. 13, Issue 21). MDPI. https://doi.org/10.3390/su132111663

Marliani, I. (2024). Literature Reviews on the Challenges and Opportunities of ESG Integration in Investment Decisions. International Journal of Business and Quality Research, 2(2), 185–197. https://e-journal.citakonsultindo.or.id/index.php/IJBQR

Mulkeen, N. (2022). National Debt - A Burden of Future Generations? https://www.psa.ac.uk/psa/news/national-debt-%E2%80%93-burden-future-generations

NOAA National Centers for Environmental Information. (2024, June). Climate at a Glance: Global Time Series. Https://Www.Ncei.Noaa.Gov/Access/Monitoring/Climate-at-a-Glance/Global/Time-Series.

Pusat Kebijakan APBN. (2020). Dinamika Utang Pemerintah Indonesia. Badan Kebijakan Fiskal, Kementerian Keuangan. https://fiskal.kemenkeu.go.id/kajian/2020/09/29/135825383169644-dinamika-utang-pemerintah-indonesia

Putra, M. A., Lie, G., & Syailendra, M. R. (2023). LEGALISASI KEBIJAKAN SOVEREIGN WEALTH FUND MELALUI LEMBAGA PENGELOLA INVESTASI DITINJAU DARI HUKUM POSITIF INDONESIA. NUSANTARA: Jurnal Ilmu Pengetahuan Sosial, 10(3), 1396–1404. https://doi.org/10.31604/jips.v10i3.2023.1396-1404

Redaction Team. (2009). Profil IFSWF. https://ifswf.org/

Redaction Team. (2010). About the Fund. https://www.nbim.no/en/the-fund/investments/#/

Redaction Team. (2013). The Russian Direct Investment Fund. https://sputnikvaccine.com/about-us/the-russian-direct-investment-fund/

Setiawan, S. A., & Tandelilin, Prof. E. (2021). Indonesia’s Sovereign Wealth Fund (SWF): Will it Work? How to Make it Work? Universitas Gajah Mada.

Sibero, R. L. T. (2024). Pembentukan Sovereign Wealth Fund Melalui Lembaga Manajemen Investasi dalam rangka Optimalisasi Investasi Asing. Jurnal Darma Agung, 32(3), 167–176.

Sugarda, P. P., Gunawan, F. I., & Dini, A. A. (2024). Sovereign Wealth Fund Development in Indonesia: Lessons Learned from Norway and Singapore. Yustisia Jurnal Hukum, 13(1), 89–116. https://doi.org/10.20961/yustisia

Supriyanto, E. E. (2021). Strategi Penerapan Kebijakan Sovereign Wealth Funds (SWFs) di Indonesia: Studi Literatur dan Studi Komparatif Oman. Jurnal Inovasi Ilmu Sosial Dan Politik (JISoP), 3(1), 10. https://doi.org/10.33474/jisop.v3i1.6959

Susilo, A. B., & efendi, I. (2020). Omnibus Law Foreign Invesment in Indonesia. www.apic.unissula.ac.id

Tim Redaksi INA. (2021). Indonesia Investment Authority Laporan Tahunan 2021. https://www.ina.go.id/annual-report-id/laporan-tahunan-2021-id

Tim Redaksi INA. (2022a). Indonesia Investment Authority Laporan Tahunan 2022. https://www.ina.go.id/annual-report-id/laporan-tahunan-2022-id

Tim Redaksi INA. (2022b). Responsible Investment. https://www.ina.go.id/responsible-investment

Wahdan Arum Inawati, & Rahmawati. (2023). Dampak Environmental, Social, Dan Governance (ESG) Terhadap Kinerja Keuangan. Jurnal Akademi Akuntansi, 6(2), 225–241. https://doi.org/10.22219/jaa.v6i2.26674

Zahroh, B. M., & Hersugondo, H. (2021). The Effect of ESG Performance on the Financial Performance of Manufacturing Companies Listed in Indonesia. AFEBI Management and Business Review, 6(2), 129. https://doi.org/https://doi.org/10.47312/ambr.v6i2.475