Dispersi Kepemilikan, Pertumbuhan Penjualan, dan Kesulitan Keuangan terhadap Kebijakan Dividen yang Dimoderasi oleh Ukuran Perusahaan

##plugins.themes.academic_pro.article.main##

Abstract

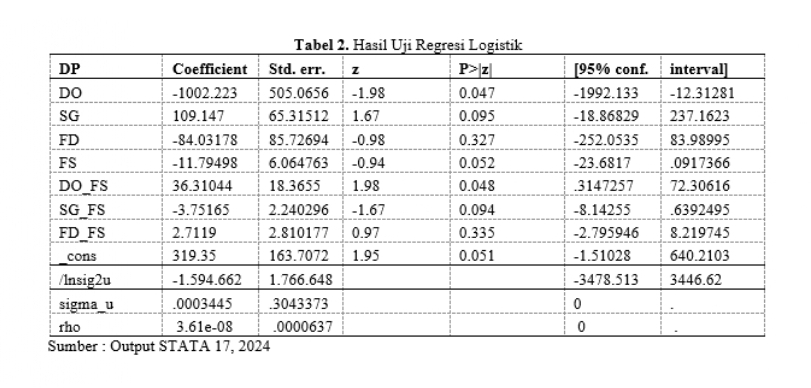

Indonesia, the largest archipelagic country, attracts both domestic and international tourists with its stunning natural beauty. The tourism sector has experienced significant growth, achieving a ranking of 32nd in the Travel and Tourism Development Index (TTDI) in 2022. This increase in tourist arrivals signals substantial business potential in the industry, drawing investors to various segments, including resort development, hotels, restaurants, and transportation infrastructure. The purpose of this research is to examine the influence of ownership dispersion, sales growth, and financial distress on dividend policy, with firm size as a moderating factor. A quantitative approach utilizing purposive sampling was employed, with data processed using STATA software. The findings reveal that only ownership dispersion significantly affects dividend policy, while firm size merely moderates the relationship between ownership dispersion and dividend policy. This highlights the importance of understanding ownership structures for optimizing dividend strategies in the tourism sector, fostering sustainable business growth.

##plugins.themes.academic_pro.article.details##

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

LPPM Politeknik Piksi Ganesha Indonesia

References

Ayem Sri, R. N. (2016). Pengaruh Profitabilitas, Struktur Modal, Kebijakan Deviden, Dan Keputusan Investasi Terhadap Nilai Perusahaan. Jurnal Akuntansi, 4(1), 31–39. https://jurnalfe.ustjogja.ac.id/index.php/akuntansi/article/view/125

Ayuni, S., Larasaty, P., Pratiwi, A. I., & dkk. (2023). Laporan Perekonomian Indonesia 2023. In Badan Pusat Statistik Indonesia. https://doi.org/9199007

Brigham, F. E., & Houston, J. F. (2010). Dasar-Dasar Manajemen Keuangan Buku Satu (11th ed.) (11th ed.). Salemba Empat.

Cheng, S. F., Vyas, D., Wittenberg Moerman, R., & Zhao, W. (2023). Exposure to Superstar Firms and Financial Distress. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.4506218

Hantono, H., Sari, I. R., Felicya, F., & Daeli, M. (2019). Pengaruh Return on Assets, Free Cash Flow, Debt to Equity Ratio, Pertumbuhan Penjualan Terhadap Kebijakan Dividen Pada Perusahaan Property and Real Estate yang Terdaftar di Bursa Efek Indonesia Periode 2014-2016. Owner, 3(2), 143. https://doi.org/10.33395/owner.v3i2.118

Hearn, B., Filatotchev, I., & Goergen, M. (2022). Dispersed Ownership and Asset Pricing: An Unpriced Premium Associated with Free Float. SSRN Electronic Journal, May. https://doi.org/10.2139/ssrn.4102188

Hermanto, L. T., & Fitriati, I. R. (2022). Pengaruh profitabilitas, likuiditas, leverage, sales growth,dan firm size terhadap kebijakan dividen pada perusahaan sektor energi yang terdaftar di bursa efek indonesia periode 2016-2020. Fair Value: Jurnal Ilmiah Akuntansi Dan Keuangan, 4(12), 5691–5706. https://doi.org/10.32670/fairvalue.v4i12.2000

Kementerian Investasi/BKPM. (2023). Kementerian Investasi Dukung Industri Pariwisata Super Prioritas Semakin Berkembang. Bkpm.Go.Id. https://www.bkpm.go.id/id/info/siaran-pers/kementerian-investasi-dukung-industri-pariwisata-super-prioritas-semakin-berkembang

Kusumah, R. W. R., Nilawidiyana, A., & Fadilah, M. F. (2022). Impact of Return on Assets, Sales Growth, Asset Growth, Cash Flow, and Liquidity (DTA) on The Organization’s Dividend Payout Ratio (Study on Financial Institution Organizations on The Indonesia Stock Exchange 2018–2020 Period). Central Asia & the Caucasus, 23(1), 432–446.

Mangasih, G. V., & Asandimitra, N. (2017). Pengaruh Insider Ownership, Institutional Ownership, Dispersion of Ownership, Collateralizable Assets, Dan Board Independence Terhadap Kebijakan Dividen Pada Sektor Finance Periode 2011-2015. Jurnal Ilmu Manajemen (JIM), 5(3).

Mazur, M., Dang, M., & Vo, T. T. A. (2020). Dividend Policy and the COVID-19 Crisis. SSRN Electronic Journal, 108765. https://doi.org/10.2139/ssrn.3723790

MENPAREKRAF. (2024). KOMISI X DPR RI RAKER DENGAN MENPAREKRAF/BAPAREKRAF. TVR PARLEMEN. https://www.youtube.com/watch?v=2fFobWLvfF8&ab_channel=TVRPARLEMEN

Muniifah, S. (2021). Pengaruh Institutional Ownership, Dispersion of Wnership, Insider Ownership, dan Firm Size Terhadap Kebijakan Dividen Pada Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia. Jurnal Manajemen Stratejik Dan Simulasi Bisnis, 2(2), 22–39. https://doi.org/10.25077/mssb.2.2.22-39.2021

Rasyid, R. F. El, & Darsono. (2022). Pengaruh Kinerja Keuangan dan Financial Distress terhadap Kebijakan Dividen dalam Masa Pandemi Covid-19. Diponegoro Journal of Accounting, 11(4), 1–13.

Samrotun, Y. C. (2015). KEBIJAKAN DIVIDEN DAN FAKTOR – FAKTOR YANG MEMPENGARUHINYA. Jurnal Paradigma, 13(01), 92–103.

Subramanyam, W. (2011). Analisis Laporan Keuangan. Salemba Empat.

Weiying, W., Weiwei, Z., Shunli, H., Xinmin, C., Bingyi, Y., Jiatuo, X., Xiuqi, Y., Xu, J., & License, C. A. (2022). Incorporating Financial Reports and Deep Learning for Financial Distress Prediction: Empirical Evidence from Chinese Listed Companies. The Lancent Pschch, 11(August), 133–143.