Analysis of Financial Data Descriptions about Investment and the Stock Market Based on Gender and Age Attributes

##plugins.themes.academic_pro.article.main##

Abstract

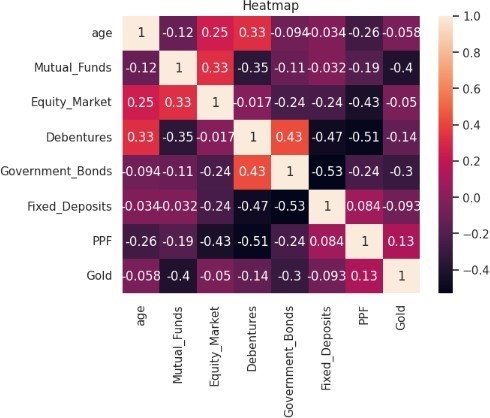

The recent surge in data science or analytics in finance is crucial for informed decision-making in financial operations. Its integration is instrumental in helping businesses mitigate operational risks, identifying and preventing potential threats such as system failures and lapses. The study methodology involves case investigations and tests utilizing K-Means, K-Nearest Neighbors (KNN), and Decision Tree algorithms. Data visualization, using various graphical representations like graphs, diagrams, maps, and other techniques, is essential to simplify data interpretation and foster intuitive analysis. Common forms include heat maps, scatter plots, pie charts, bar graphs, line graphs, and maps, contributing significantly to presenting data comprehensively, offering insightful analyses, and achieving research objectives..

##plugins.themes.academic_pro.article.details##

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

References

[2] Y. Mardi, “Data Mining?: Klasifikasi Menggunakan Algoritma C4.5,” Jurnal Edik Informatika, Vol. 7, No. 1, Pp. 213–219, 2023.

[3] R. Puspita And A. Widodo, “Perbandingan Metode Knn, Decision Tree, Dan Naïve Bayes Terhadap Analisis Sentimen Pengguna Layanan Bpjs,” Jurnal Informatika Universitas Pamulang, Vol. 5, No. 4, Pp. 646–654, Dec. 2021, Doi: 10.32493/Informatika.V5i4.7622.

[4] H. Hiyanti, L. Nugroho, C. Sukmadilaga, And T. Fitrijanti, “Peluang Dan Tantangan Fintech (Financial Technology) Syariah Di Indonesia,” Jurnal Ilmiah Ekonomi Islam, Vol. 5, No. 3, Pp. 1–8, Jan. 2020, Doi: 10.29040/Jiei.V5i3.578.

[5] D. Triyansyah And D. Fitrianah, “Analisis Data Mining Menggunakan Algoritma K-Means Clustering Untuk Menentukan Strategi Marketing,” Incom Tech, Jurnal Telekomunikasi Dan Komputer, Vol. 8, No. 3, Pp. 163–182, 2018, Doi: 10.22441/Incomtech.V8i2.4174.

[6] E. Budiono, “Analisis Financial Knowledge, Financial Attitude, Income, Locus Of Control, Financial Management Behavior Masyarakat Kota Kediri,” Jurnal Ilmu Manajemen (Jim), Vol. 8, No. 1, Pp. 284–295, 2020.

[7] A. K. Ngamel, “Analisis Finansial Usaha Budidaya Rumput Laut Dan Nilai Tambah Tepung Karaginan Di Kecamatan Kei Kecil, Kabupaten Maluku Tenggara,” Jurnal Sains Terapan Edisi Ii, Vol. 2, No. 1, Pp. 39–47, 2012.

[8] E. Subiyantoro And F. Andreani, “Analisis Faktor-Faktor Yang Mempengaruhi Harga Saham (Kasus Perusahaan Jasa Perhotelan Yang Terdaftar Di Pasar Modal Indonesia),” Jurnal Manajemen & Kewirausahaan, Vol. 5, No. 2, Pp. 171–180, 2003, [Online].

[9] K. Ridha Pranita And F. Titik Kristanti, “Analisis Financial Distress Menggunakan Analisis Survival,” Nominal: Barometer Riset Akuntansi Dan Manajemen, Vol. 9, No. 2, Pp. 240–257, 2020, [Online].

[10] A. W. G. P. Putro And T. Setiadi, “Penerapan Klasifikasi Decision Tree (C4.5) Untuk Memprediksi Kelulusan Siswa Sekolah Dasar Di Kecamatan Juai,” Jurnal Format, Vol. 12, No. 2, Pp. 151–157, 2023.